Small retail companies and stores often have a higher asset turnover ratio because they typically generate a large number of sales relative to the cost of their assets. The asset turnover ratio is effective at comparing businesses in the same sector, but it is not meaningful when comparing businesses that operate in different industries. A higher asset turnover ratio is typically seen as better, as it indicates that the company is able to more efficiently produce profits based on their available inventory. For example, an asset turnover ratio of 0.50 indicates that the company in question is able to convert every dollar of assets into 50 cents worth of revenue. The formula was first used in the 1920s as part of the Dupont company's analysis and has become an industry standard since then. The asset turnover ratio is a mathematical function that calculates how efficiently a company converts assets into revenue. Related: 3 Methods for Classifying Tangible Assets What is the asset turnover ratio?

#ASSEST TURNOVER RATIO FORMULA HOW TO#

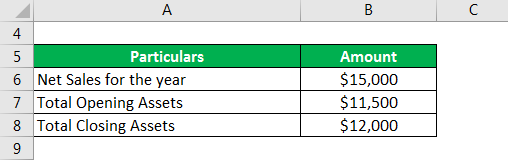

In this article, we discuss how to use the asset turnover formula to calculate asset turnover ratio, with examples. This ratio is known as the asset turnover ratio.

When looking at profits, many accountants analyze the ratio between each dollar of assets compared to each dollar of sales. Understanding how a business converts assets into revenue can be helpful if you want to learn about how the business operates. There is also text on the whiteboard that reads "Asset turnover ratio = total sales/average total assets" There is a woman sitting in a wheelchair writing on a whiteboard.

0 kommentar(er)

0 kommentar(er)